how much can you contribute to rrsp

This means you will have to find your tax return anyway so its probably easier just to get your notice of assessment. Your new annual contribution room is 18 of your previous years earned income up to an annual limit.

Should You Contribute To An Rrsp Or Tfsa Smile Conquer Investing Money Personal Finance Lessons Personal Finance

How much can you contribute towards your RRSP.

. RRSP contribution This amount is either 18 of your earned income in the previous year or the 2019 RRSP limit of 26500 - whichever is lower there may be additional room to contribute based on factors such as unused RRSP amounts PRPP. If your 2017 contribution room is 26010 the maximum amount you can make total RRSP contributions of 41010 15000 26010 in 2017. You must also have contribution room available which is identified on your annual Notice of Assessment sent by the Canada Revenue Agency CRA. Youre allowed to over-contribute up to 2000 to an RRSP.

Your limit is calculated by taking the annual RRSP deduction limit and adding your unused contribution room carried over from previous years. An RRSP contribution limit refers to the maximum amount that an account holder can deposit into their RRSP every year. If you have earned income and file an income tax return in Canada you can contribute to an RRSP until December 31 of the year you turn 71. If you earn 151280 or more per year you can contribute up to the CRAs annual maximum dollar limit of 27230 for 2020.

If you go over your RRSP contribution limit by 2000 or less you wont be penalized. The limit is subject to a maximum of 18 of your previous financial years income. In other words if you make 60000 a year and contribute 5000 to your RRSP your taxable income will only be 55000. Theres a limit to how much you can contribute to your RRSP and it changes each year.

The limit is usually based on your income and is different for every person. For the 2021 tax year you can contribute up to 18 of the earned income you reported for last years taxes 2020 tax filing or 27830 whichever is less. The total amount you can contribute to your RRSP each year is made up of your contribution limit for the current year plus any carry-forward contribution room from previous years. The 2021 deduction limit is 18 of your earnings in the past year or 27830 whichever is less.

The amount you can contribute is determined by the earned income you report on your tax return. Up to 35000 of RRSP withdrawals can be used to buy a qualifying home under the Home Buyers Plan. However you cant deduct these excess contributions from your taxable income. RRSP withdrawals can be taken to fund some of these costs like education or a home down payment.

How much you can contribute. Contributions made to your RRSP are tax deductible. For the 2020 tax year you can contribute up to 18 of the earned income you reported for last years taxes 2019 tax filing or 27230 whichever is less. Benefits of an RRSP.

If your pension benefits increase for an adjustment for the period after 1989 you also may be subject to a past-service pension amount PSPA if it is authorized by the minister under terms of the Income Tax Act. The limit for 2021 is 27230 up from 26500 in the last financial year. Theres a limit to how much you can contribute to your RRSP and it changes each year. The Lifelong Learning Plan permits withdrawals of up to 20000 from an RRSP to fund eligible post-secondary education.

For the 2021 tax year you can contribute up to 18 of the earned income you reported for last years taxes 2020 tax filing or 27830 whichever is less. The annual RRSP limit for 2020 the annual limit is 27230 That exceeds one of the following items. In RRSP 102 we discussed where to look for your RRSPs available contribution room on the CRA websiteThe available contribution room is the maximum amount that you can contribute to an RRSP account. You carry this forward to 2017.

Although if you withdraw the extra funds right away and send a letter to the CRA explaining that it was a legitimate mistake you may be able to obtain a waiver of the excess contribution tax. Fortunately youre able to beef up your 2020 contributions even after the calendar turns. The PA reduces your RRSP contribution room allowing you to contribute less for the current tax year. If Jessica made the entire 60000 contribution to the RRSP and deducted the entire amount on her tax return she would get a tax refund of about 12375.

The lesser of the two following items. Make sure you can afford to make the loan payments and plan to pay back the loan right away. You may contribute to your RRSP until December 31 of the year in which you reach age 71. If you earn 80000 per year you can contribute up to 14400 annually to an RRSP.

It is also dependent on the set annual deduction limit or unused contributions. Your RRSP contribution limit for 2021 is 18 of earned income you reported on your tax return in the previous year up to a maximum of 27830. 18 of your earned income in the previous year. Fortunately youre able to beef up your 2021 contributions even after the calendar turns.

You can probably contribute more money as unused contribution room since 1991 can be carried forward indefinitely. Thinking about borrowing to make an RRSP contribution. If you have a spouse under the age of 71 you can make spousal contributions to their RRSP until. Here is an article I wrote a few months back that further explains these tax deductions.

To get your RRSP limit you will need your Social Insurance Number SIN your month and year of birth and the total income you reported on line 150 of your income tax return for the previous year. For the 2018 tax year the limit is 18 of your earned income or 26230 whichever is lower. Every year the Canada Revenue Agency CRA announces an upper limit for investment in the RRSP account. Your pension adjustments PA a prescribed amount.

Fortunately youre able to beef up your 2021 contributions even after the calendar turns. Another option is to use half the deduction 30000 this year and save the other half 30000 for next year. The RRSP contribution age limit is 71. Your RRSP contribution or deduction limit depends on your income.

Excess contributions over 2000 on the other hand are penalized and you must pay a 1 percent tax per month. You can contribute to an RRSP until December 31 of the calendar year when you turn 71. In this article I will discuss how to determine the optimal contribution amount to get the most from your RRSP. Theres a limit to how much you can contribute to your RRSP and it changes each year.

But if you go over that you can be charged 1 per month on the excess amount.

An Rrsp Lets You Save For Retirement Your Money Grows Tax Deferred It Helps You Sav Life And Health Insurance Retirement Savings Plan Saving For Retirement

Financial Advisor Edmonton Ab Finance Infographic Retirement Savings Plan Budgeting

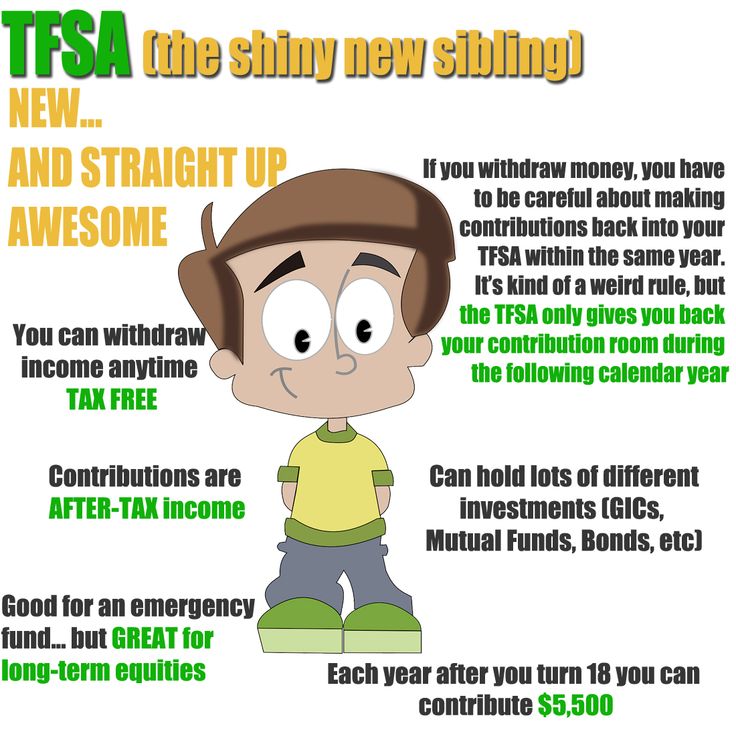

Tfsa Vs Rrsp How To Choose Between The Two 2021 Canadian Money Personal Finance Blogs Personal Finance

Infographic Rrsp Versus Tfsa Www Ativa Com Finance Infographic Retirement Savings Plan Budgeting

Investing In An Rrsp Contribution Room And How To Use The Rrsp Genymoney Ca Investing Personal Finance Lessons Money Management

Posting Komentar untuk "how much can you contribute to rrsp"